Americans’ Shifting Interests in Smart Irrigation and Xeriscape

Water-wise landscaping concepts have undergone remarkable growth over the past two decades, reflecting shifting public priorities around sustainability, technology, and climate adaptation.

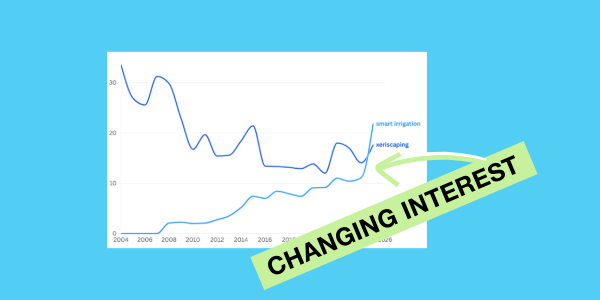

By analyzing Google Trends data and state-by-state patterns, a new report from The Valve by Healthy Green Spaces Coalition (HGSC) shows how smart irrigation is gaining ground as a leading water‑saving solution, while xeriscaping is steadily losing momentum in the public conversation.

-

- Public interest in water‑wise landscaping has shifted from design‑focused ideas like xeriscaping toward technology‑driven solutions, with xeriscaping search interest falling by about 16 points since 2004 while smart irrigation has risen by more than 20 points over the same period. The Google Trends search index shows relative search interest, where 100 is peak popularity for a term, and 0 means minimal or no interest during the selected period.

-

- Searches for water‑saving technologies have surged, with smart irrigation jumping from about 0.5 to 22.9 and smart controllers from 1.7 to 23.1, underscoring how digital tools are rapidly becoming central to landscape water management.

-

- Search interest for native plant landscaping rose from 0 to 32 between 2004–2008 and 2020–2025.

- Montana leads in interest for water-wise landscaping with a mean interest score of 69.6, while New York lags at 12.3.

Is the future of water‑wise landscaping shifting from xeriscaping to smart irrigation?

Google Trends data reveals a change in how people think about water‑wise landscaping over time. In the mid‑2000s, xeriscaping was the dominant search term for drought‑friendly yards. Its average annual interest sat in the mid‑30s on the 0–100 index in 2004, but has since declined to the high‑teens by 2025, a drop of roughly 16 points in mean search interest.

In contrast, smart irrigation has followed the opposite path. It started the period with essentially no measurable search interest (near zero in 2004) and has climbed steadily to the low‑20s on average by 2025, gaining more than 20 points over the same horizon.

Taken together, these trends suggest a shift from an early focus on planting style and design language (“xeriscaping”) toward technology‑driven solutions (“smart irrigation”) as the primary way people think about managing water outdoors.

Growing Mainstream Water‑Wise Practices

Interest in water-wise landscaping has surged since the mid-2000s, with numerous concepts shifting to mainstream adoption. Several specific keywords now reflect lasting public awareness and behavioral change.

Top growth keywords (2020–2025 vs. 2004–2008):

- Native plant landscaping: 0 → 32 average interest, marking rapid mainstreaming.

- Lawn replacement: 19.4 → 46.4, driven by changing consumer priorities.

- Smart irrigation: 0.47 → 22.9, showing major adoption of water-saving technology.

- Smart controllers: 1.67 → 23.1, reflecting tech’s rising role in landscape management.

- Sustainable landscaping: 1.02 → 18.1, signaling growing environmental awareness.

Keywords with the slowest development:

- Irrigation alternatives: remained flat at zero until 2020, reaching only 6.4 in recent years.

- Early search interest for some topics stayed near baseline before recent increases, suggesting late emergence.

Where is the Interest for Water-Smart Landscaping Highest Across The States?

State-by-state analysis uncovers major regional disparities in public interest toward water-wise concepts, revealing both leaders and laggards in public interest over Water-Smart Landscaping solutions. The states are ranked based on their mean interest across all keywords over time.

States with the highest interest:

- Montana: mean interest across all keywords of 69.6.

- Colorado: mean interest across all keywords of 57.3.

- Vermont: mean interest across all keywords of 51.

- Idaho: mean interest across all keywords of 50.9.

- South Dakota: mean interest across all keywords of 46.8.

States with the lowest interest:

- New York : mean interest across all keywords of 12.3.

- Pennsylvania: mean interest across all keywords of 14.2.

- Illinois: mean interest across all keywords of 16.4.

- New Jersey: mean interest across all keywords of 16.6.

- Georgia: mean interest across all keywords of 16.7

Methodology

Data

We used a Google Trends export with:

- A time series of monthly search interest (0–100 index) for multiple keywords in the US since 2004.

- A state-level table of average search interest (0–100) for the same keywords over 2004–2025.

Keyword trends and growth

- Aggregated monthly data to annual means by keyword and year.

- Defined two periods:

- Baseline: 2005–2014.

- Recent: 2015–2025.

- For each keyword, computed:

- Average annual interest in 2005–2014.

- Average annual interest in 2015–2025.

- Change over 10 years as a growth metric.

- Ranked keywords by change over 10 years to find the top 5 with the most growth.

- Separately, averaged each keyword’s annual interest across all years (2004–2024) and ranked to find the top 5 with the highest long‑run average interest.

- From the long state data, aggregated by state to compute: Mean interest across all keywords.